Sales Tax Exemption for Resellers

Reselling products can be tricky, but it doesn’t have to be. Whether you’re a small business owner printing custom greeting cards, a brewery offering branded merchandise and apparel or a literary magazine selling quarterly booklets, the resale and sales tax exemption process is simple with Smartpress.

Learn about sales tax exemption and how to apply for reseller certificates below.

Sales Tax Exemption

So what does sales tax exemption really mean? Here’s a quick overview of how it works:

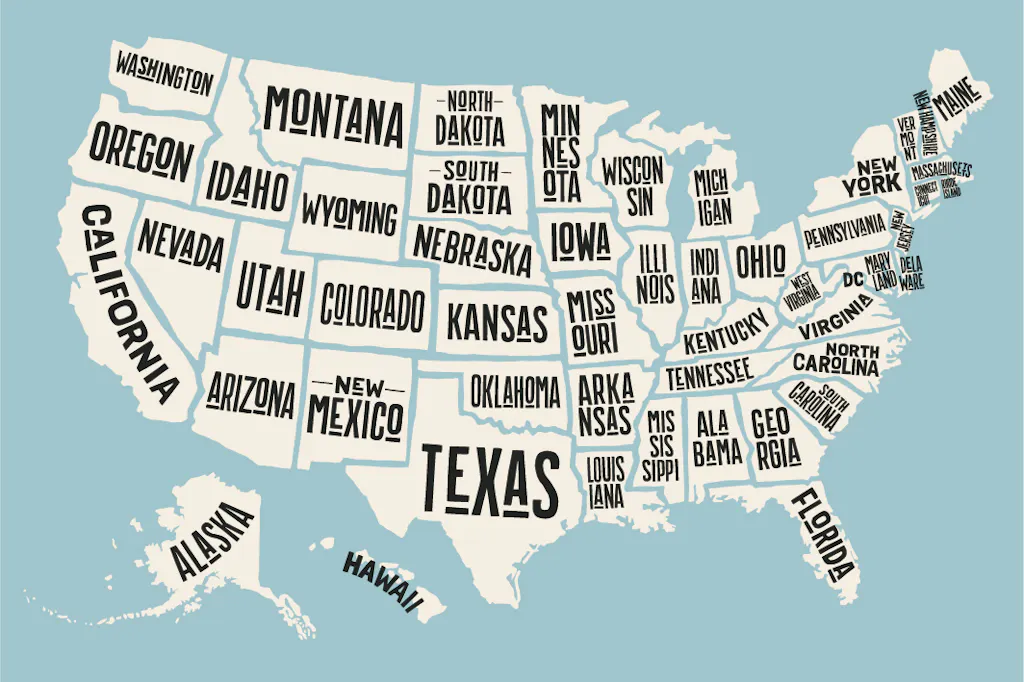

- Smartpress charges sales tax on orders shipping to the states listed in our Sales Tax Policy:

- Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin and Wyoming

- If the state is not listed, sales tax will not be charged.

- Sales tax is charged by the state to which the order is shipping.

- For example, an order shipping to Arizona will be charged Arizona sales tax even if the purchaser is located in Minnesota.

- Sales tax laws vary by state, including what types of organizations are exempt from sales tax.

- Some states allow for nonprofits, resellers, manufacturers, advertisers, etc. to be exempt.

- Smartpress requires a resale certificate (or exemption certificate) to refund sales tax.

Reselling Your Printed Pieces

Before you begin the reselling process, you’ll want to consider the following:

- Generally, if you’re reselling the same product ordered on Smartpress to a different customer, you’re considered a reseller.

- Sales tax laws vary by state, so be sure to look up the guidelines for the state to which your order is shipping.

- Providing a resale certificate allows Smartpress to refund sales tax on your order. This ensures sales tax won’t be double charged when you later resell the product to your customer with sales tax.

Products Eligible for Resale

Depending on the state to which you are shipping, Smartpress products may or may not be eligible for resale – each state has its own tax guidelines.

Typically, all products are taxable if you are shipping them to a taxable state (listed here). Certain states, however, tax products differently. For example, in Minnesota, clothing is not charged sales tax.

Resale Certification

Once you determine your online printing projects are eligible for resale, the next step is to certify your sales tax exemption and let us know. Here’s how:

- Remember, tax exemption depends on the state to which your order is shipping.

- Visit your state’s Department of Revenue website for steps on how to register as a reseller (and find resale forms there, too).

- Provide Smartpress with your resale certificate.

- Smartpress will add your account as tax exempt in the state for which the resale certificate applies.

Tips & Tricks

Here are some helpful hints to ensure certifying your tax exemption goes smoothly.

- Income tax exemption paperwork and your seller’s permits cannot be used to refund sales tax to you. Instead, please provide a resale certificate, which can be found on each state’s Department of Revenue website.

- Remember, sales tax is charged based on the state to which your order is shipping. This means that to refund sales tax, the resale certificate must also be for the state to which your order is shipping.

- For example, you’re shipping a product to California. In this case, if you submit only a Minnesota resale certificate (ST-3), you will still be charged sales tax on the order shipped to California unless you also provide a California resale certificate.

- The resale certificate needs to be in the name of the reseller placing the order with Smartpress. name of the customer placing the order (the person to which you’re reselling). As the reseller, you must submit your own resale form, not just your customer’s sales tax exemption certificate.

As a customer-focused online printer, Smartpress has a team of print experts ready to help you through the resale and sales tax exemption process. If you have questions about this or any of our online printing services, please contact customer service.